Renters Insurance in and around New York

Renters of New York, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

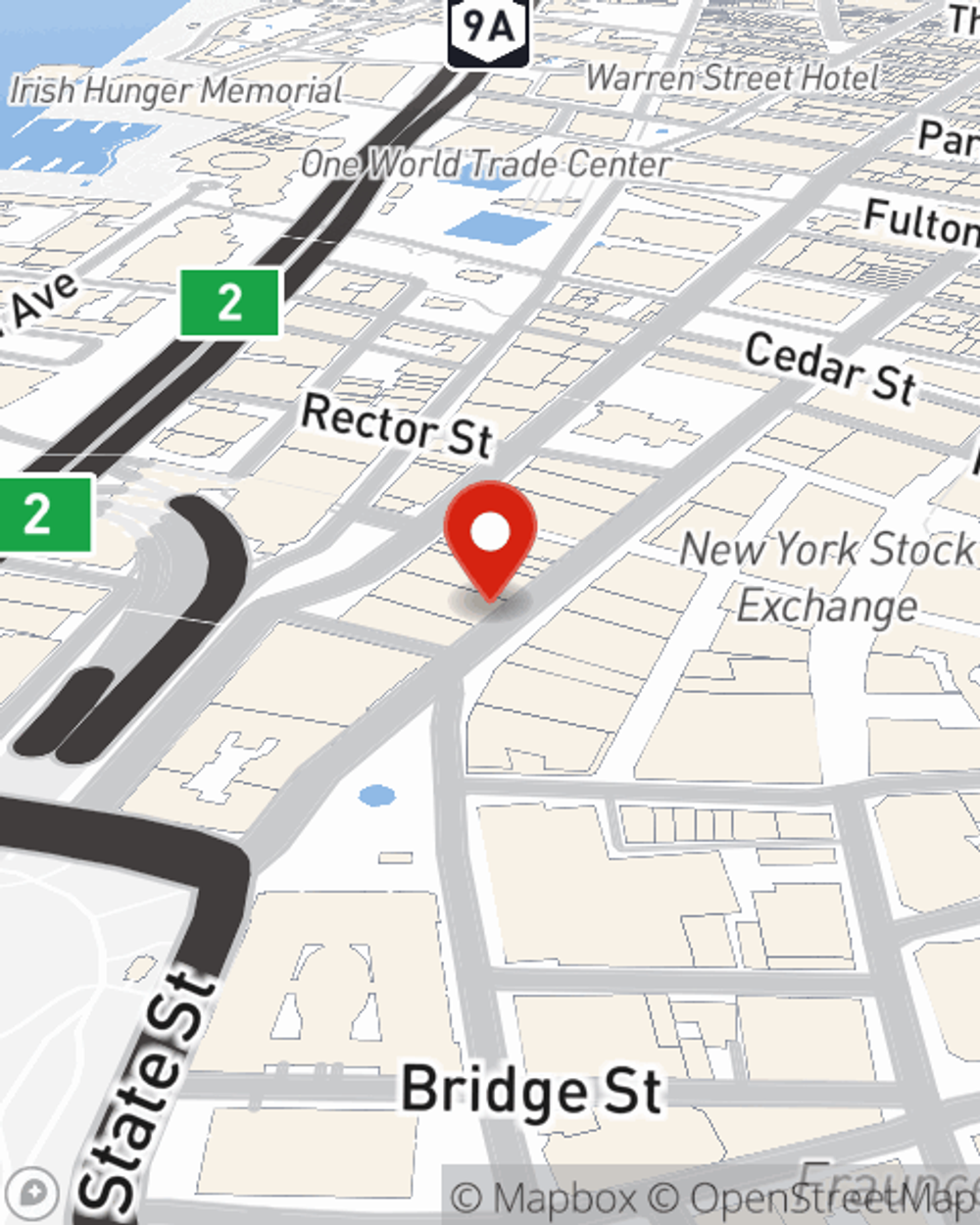

- Manhattan

- Brooklyn

- Queens

- Staten Island

- Battery Park City

- Financial District

- Upper East Side

- Greenwich Village

- Upper West Side

- Forest Hills

- Brooklyn Heights

- Park Slope

- Astoria

- Long Island City

There’s No Place Like Home

Think about all the stuff you own, from your TV to bookshelf to lamp to bedding. It adds up! These possessions could need protection too. For renters insurance with State Farm, you've come to the right place.

Renters of New York, State Farm can cover you

Renters insurance can help protect your belongings

Open The Door To Renters Insurance With State Farm

Renting is the smart choice for lots of people in New York. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance probably covers a break-in that damages the door frame or tornado damage to the roof, that doesn't cover the things you own Finding the right coverage helps your New York rental be a sweet place to be. State Farm has coverage options to correspond with your specific needs. Fortunately you won’t have to figure that out alone. With personal attention and fantastic customer service, Agent Julie De Rossi can walk you through every step to help you build a policy that protects the rental you call home and everything you’ve invested in.

There's no better time than the present! Visit Julie De Rossi's office today to see how helpful renters insurance can be.

Have More Questions About Renters Insurance?

Call Julie at (212) 514-8260 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Julie De Rossi

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.